This post may contain affiliate links. Read my disclosure policy here.

I’m a big believer that the only way the wee ones will learn to be responsible adults is if they are responsible children – to the point that they’re capable of handling it. As they grow older, I hand them more responsibility, and they understand that the only way our house functions well is that we all pitch in to work together.

That said, it isn’t always easy. I sometimes have to threaten to take away privileges or confiscate toys to have them help out, but I’d much rather do something positive for them. My Job Chart is a free online chore chart where you can assign tasks to children and reward them for a job well done.

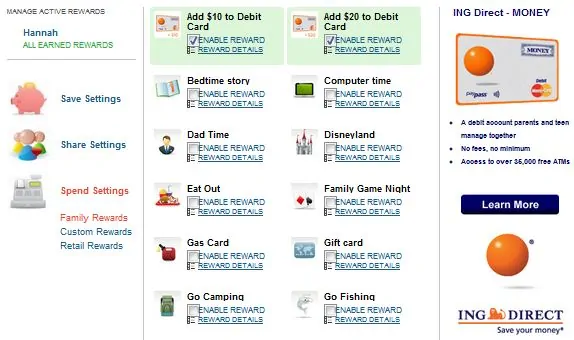

It’s an easy system where you set up your family and assign chores for them to do, both from a set list as well as ones you can customize yourself. You set the frequency with which they need to be done, and add point values for their completion. It’s then the child’s responsibility to log onto the My Job Chart and mark what chores they’ve completed. It’s a great way for them to be responsible for themselves without you nagging constantly. And yes, the parent has the ability to approve chore completion so your sneaky child (that would be Little Miss again) can’t simply say she’s done everything when she really hasn’t.

The points are worth money, so the child sees what accumulates and how quickly the work they are doing adds up to something meaningful. You have the option of paying it out youself, of course, but My Job Chart has also partnered with ING Direct Bank where you can set up an Kids Savings Account that has no fees and no minimum balances for your child and transfer money directly there so that they learn to save money, as well. The cool thing about setting up this account is that $20 gets deposited in that account just for opening it. That’s a nice bonus for any child who is saving for something – and goes a long way to affording the scooter Mister Man wants to buy himself.

ING Direct Bank has also designed a debit card for children ages 9 and older as a new feature of My Job Chart. The MONEY Debit card offered by ING Direct allows you to transfer money directly to the debit card for the child and can be spent anywhere MasterCard is accepted. It also has a process to stop transactions on a card once you report it lost or stolen.

The best part of the MONEY Debit card is that it allows parents to track how children are spending money. The MONEY Debit card texts parents each time it is used to let us know where the debit card was used and how much the child spent. Beyond just knowing how the money is being spent, I love the idea of being able to sit down with my child and talk about why they spend what they spend and whether they felt like they made good choices. It adds another level of accountability to what they’re doing.

I’m sure my children will buy silly or wasteful things at some point. I’m sure they’ll buy something they regret and later wish they had saved it for something bigger they really wanted. But I’d rather they learn these lessons now when the consequences are small. I’d rather they make mistakes when it isn’t something that will harm them in the long term. I know they’ll learn from those lessons because I did. And when they learn how hard work is tied to the reward so directly, I can’t wait to see the adults they’ll become some day.

In the interest of full disclosure, I was compensated for writing this post. As always, all opinions remain my own.

Written by 5 Minutes for Mom contributor Michelle who very vividly remembers the day she couldn’t pay a bill as a teen and hopes the wee ones learn their lessons well and young. See what else the wee ones are learning on her blog Honest & Truly! or follow along on Twitter where you can find her @HonestAndTruly.

Leave a Comment